It's not clear which policy tipped markets over the edge – or which one Chancellor can reverse to put the genie back in the bottle

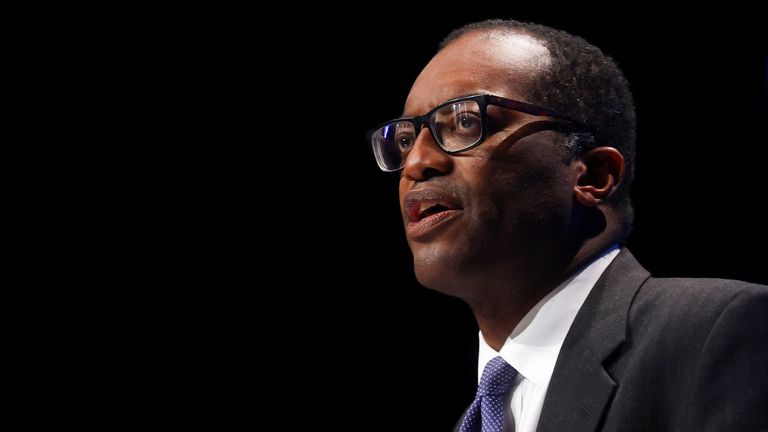

Chancellor Kwasi Kwarteng gave his keynote speech at the Tory Party conference on Monday, just hours after making a U-turn on his pledge to cut the 45p rate of income tax for higher earners.

Monday 3 October 2022 20:50, UK

Back in the George Osborne era, the Conservative party conference was a place Tories came to unveil new policies.

Each year, come what may, Mr Osborne would turn up to conference with new eye-catching policies that would turn the dial.

It was at a conference years ago that he announced plans to create the Office for Budget Responsibility.

Chancellor's speech 'rubbed salt in the wounds' - follow live politics updates

Freezing public sector pay, credit easing, "shares for rights" - they all happened at party conferences.

In 2022, it turns out that record was turned on its head. The chancellor came here not to create a policy, but to destroy one. He came here not to turn up the volume, but to turn it down.

Kwasi Kwarteng's first conference speech as chancellor was supposed to be as safe and low-key as possible.

And you can understand why. No other fiscal event in recent history has elicited as horrified a response as followed his mini-budget a couple of weeks ago.

The pound slumped, interest rates rose and fears about the country's creditworthiness multiplied. Today was all about calming that down, not stoking them up.

The decision in the morning to cancel the abolition of the 45p tax rate (it's still slightly unclear exactly how involved Mr Kwarteng was in it) was not just a serious U-turn.

It was also something else, the first time the government has acknowledged - clearly and emphatically - that it made a mistake, and not just a minor communications error, but a big, fat blunder.

It was the first moment the government shifted along the grief spectrum from denial toward acceptance.

And it seemed to have an impact. The pound has been stronger ever since that news emerged.

Indeed, at the very time the chancellor was speaking, it finally rose back above the levels it was at before his mini-budget.

His speech contained nothing to spook markets further. So perhaps that counts as a mark of success.

His problem, however, is a deeper one. Because it's not altogether clear which policy was responsible for tipping markets over the edge the Friday before last (the 45p tax rate, politically explosive as it was, was peanuts in fiscal terms), it's not clear which one he can reverse to put the genie back in the bottle.

And that comes back to a bigger lesson: that this bears all the signs of a credibility crisis, where markets react not to a single decision but to something else - a feeling, a vibe, something unquantifiable.

Read more:

Truss's U-turn on 45p tax rate will embolden her many critics

Toxic impression created that Truss and Kwarteng not getting on

Kwarteng faces calls for inquiry after party with hedge fund managers

Credibility crises are trickier to escape than simple policy mistakes, because no one really has the recipe for credibility in the first place.

It is an enigma. But repairing it may prove to be the hardest mission of Liz Truss's premiership, however long it lasts.